We committed to tracking our monthly net worth back in 2016 and we’ve kept it up for 5+ years!

We track our net worth monthly because it’s easy to feel like you’re not making progress until you look back to see where you’ve been.

Your net worth is your assets (what you own) minus your liabilities (what you owe). Finding your net worth number is the first step on the path to financial freedom, and is helpful information to have. Don’t be intimidated if the number is negative when you first start — information is power! Even if you’ve had financial challenges in the past, you can’t move forward until you have a clear picture of your financial situation.

Here’s some context:

In 2017, we were 32 and 33 with one child, aged 15.

Our family was living outside of the US on a generous expat package, which helped us get started on the path to financial independence. We were still living rent-, car-, and debt-free!

Our monthly expenses are <$2,500 and include the following:

- Utilities: electricity, water, internet

- Mobile phones

- Food (groceries + eating out)

- Transportation

- Miscellaneous (clothing, home purchases, gifts, etc.)

Note: our monthly expenses do NOT include travel expenses, as we save each month and pull from those savings to cover travel costs.

In 2017:

- We had been living outside of the US for more than two years and were still loving it!

- Mr. Unsettled completed his original 2-year contract and we decided to extend again for “just one more year”, committing to staying overseas until mid-2019.

- We continued working with our Certified Financial Planner and met with her regularly throughout the year.

2017 brought a lot of travel! We were lucky enough to spend some time in Bali and Hong Kong as a family. We also traveled back to the US for the North American summer and the Christmas/New Year holidays. I also was able to take a trip to South Korea and also spent 7 weeks traveling solo around Europe!

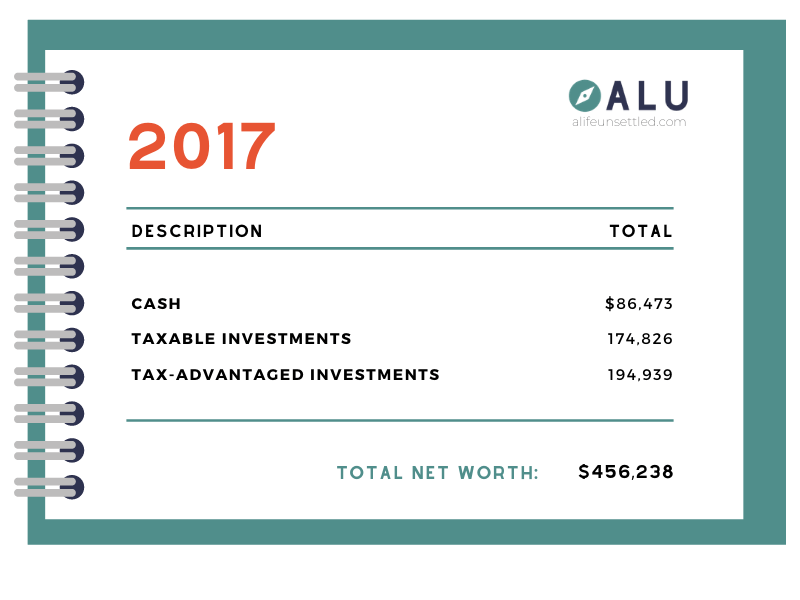

Here’s how our financial picture looked at the end of 2017:

And because I find this bit super helpful, here’s the change from 2016:

Cash +$6,333

Taxable Investments +$64,428

Tax-Advantaged Investments +$57,239

Debt: $0

Total Change: +$128,000

Our cash increased a bit, but we weren’t prioritizing keeping a ton of cash on hand at the time. And we spent a good chunk of money on travel. At this point we were still setting aside cash to cover a move back to the US since we’d sold our house, cars, and most of our stuff and knew we’d need to replace a lot of it when we returned.

The investment accounts increased due to our regular monthly deposits into our taxable investment accounts. In addition, Mr. Unsettled maxed out his 401k and his company was very generous with their matching contributions. The rest of the increase is attributed to market growth.

In 2017 we were focused on setting ourselves up for freedom from having to make decisions based on money. Our main goal at that time was to increase our wealth as much as possible until it was time to go “home”. At the beginning of 2017 we thought we’d be moving back to the US in 2018, before our kid started 10th grade. We were thrilled that it looked like we were on track to reach the half-millionaire club by the time we were scheduled to repatriate!

In mid-2017 we signed a new 1-year contract ensuring we could stay abroad through at least 2019, and by then we were pretty solid in our decision to stay outside of the US for as long as possible. Once we realized that we’d likely have a few more years of intense savings, we started realizing that if we were intentional with our plan we might actually be able to achieve FIRE!