We’ve been keeping track of our overall financial picture since 2015. We got really serious and committed to tracking our monthly net worth back in 2016. I’m happy to report that we’ve kept it up for 5+ years!

Tracking our net worth on a monthly basis has been so helpful because it’s easy to feel like you’re not making progress until you look back to see where you’ve been. I love seeing these annual recaps for the same reason!

If you’re not familiar, your net worth is your assets (what you own) minus your liabilities (what you owe). Finding your net worth number is the first step on the path to financial freedom, and is helpful information to have. Don’t be intimidated if the number is negative when you first start — information is power! Even if you’ve had financial challenges in the past, you can’t move forward until you have a clear picture of your financial situation.

Here’s some context:

In 2019, we were 34 and 35 with one child, aged 17. Our family had been living outside of the US on a generous expat package, which helped us get started on the path to financial independence. We were still living rent-, car-, and debt-free!

Our monthly expenses are <$2,500 and include the following:

- Utilities: electricity, water, internet

- Mobile phones

- Food (groceries + eating out)

- Transportation

- Miscellaneous (clothing, home purchases, gifts, etc.)

Note: our monthly expenses do NOT include travel expenses, as we save each month and pull from those savings to cover travel costs.

In 2019 we:

- Had been living outside the US for nearly 5 years and were officially in no hurry to move back to the US.

- Had just negotiated an extra contract extension allowing us to remain in our current country in order to allow our teenager to finish high school at her current school.

- Bought our first rental property, a single family home (SFH) purchased through a turn-key provider in Birmingham.

After a hectic year of travel in 2018, we slowed down a bit in 2019. We took a few local trips but otherwise the only traveling we did was back to the US to visit family during the North American summer and the Christmas/New Year’s holidays. We were fine slowing down because we had an epic year of travel planned for 2020…you can see how that turned out here and here. Sigh.

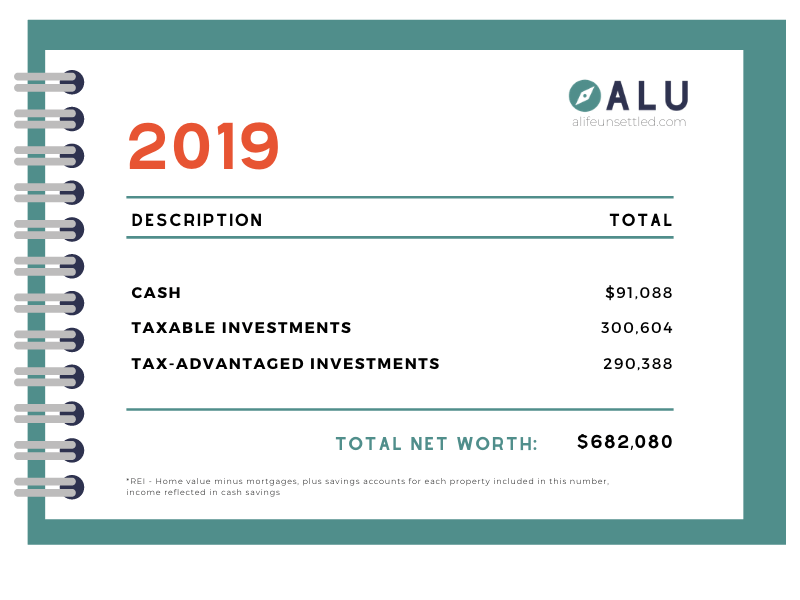

Here’s how our financial picture looked at the end of 2019:

And because I find this bit super helpful, here’s how our numbers changed from 2018:

Cash ($219)

Taxable Investments* +$82,650

Tax-Advantaged Investments +$71,884

Debt: $0

Total Change: +$154,315

*REI – Home value less mortgage included in this number, income reflected in cash savings

Our cash decreased. This was due to putting 25% down on our first rental property, but we continued to save each cash month so the growth was (basically) a wash.

The investment accounts increased! This can be credited to us adding an average of $3,300/month to our taxable investment account in 2019. And Mr. Unsettled maxed out his 401k contributions and received a company match to the tune of about 10% of his salary. The rest of the gains can be attributed to market performance.